"My Competitors Aren't Close"

Don't kill your pitch.

You may be right, your idea, app or business may have a very unique selling proposition to the point you “do not have” any existing competition. You may have addressed the accessibility issue and having an easy onboarding process that none of your rivals even come close. This may be a proud thing to shout about during your pitch but it comes with a cost. In this piece, we are going to explore how saying that you don’t have competition is killing your deck, even when you really don’t have competition.

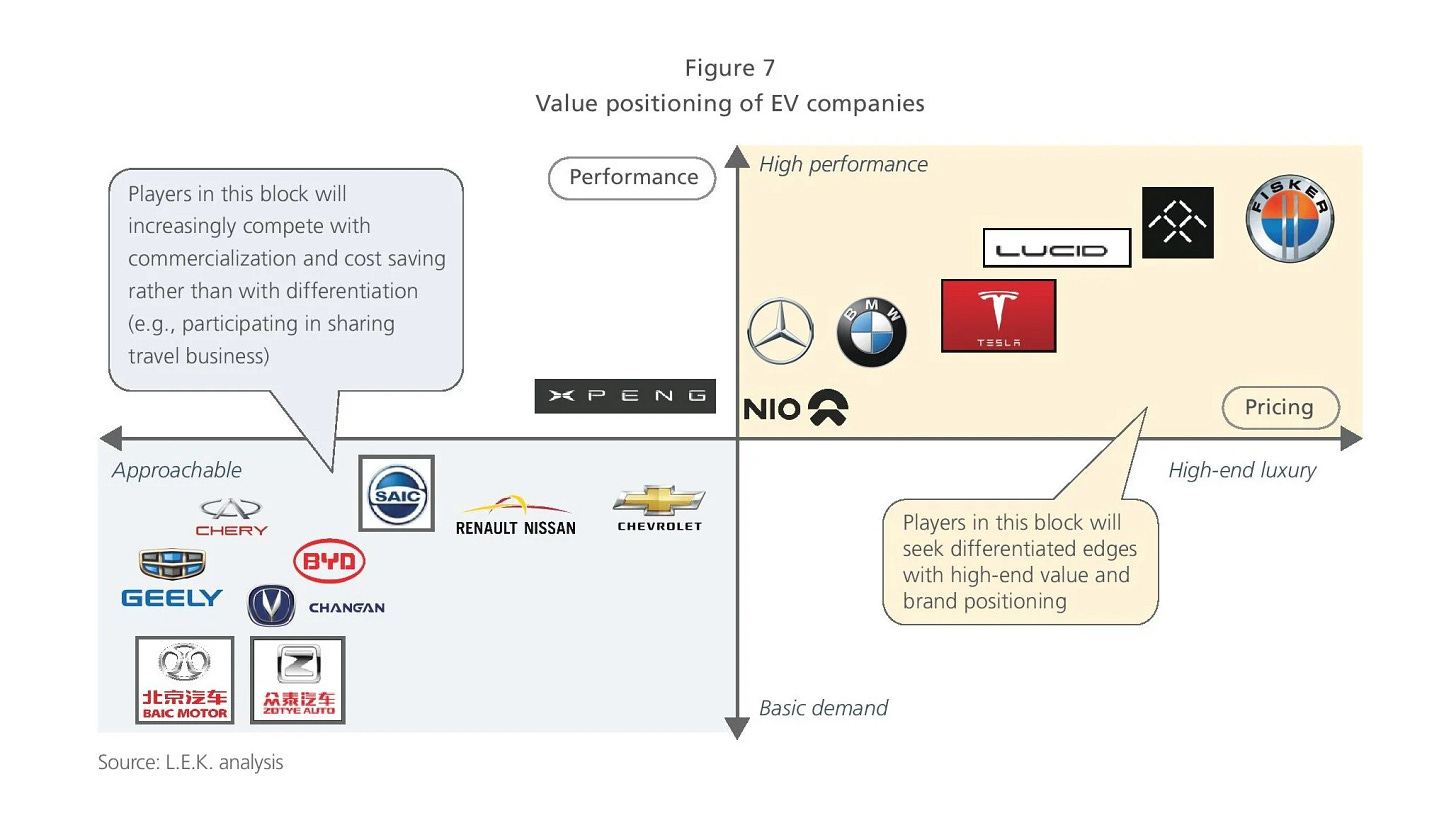

Imagine you are in a pitching session with 3~6 “sharks” or “dragons” guarding their treasure of funding, you get to the page where you compare value proposition against existing market players and you plot your company high toward the right. Perhaps you may even say that existing players are fighting on this corner, and we are in this corner where we surpass all our competitors and this is why you need to invest with us. In my experience, this would not work with either big or small players. Today I am going to share why.

Options

Understand this, big and small institutional investors (venture capitalists, private equity and government institutions) have options. You are mistaken if you think that their alternative is your closest competitor who is not very close and you’re the best option in the market. Their options are EVERY. SINGLE. STARTUP. in the immediate investable realm. With today’s technology and accessibility, you are, at the very least, competing in your region (not just city nor country) which may consist several countries’ worth of startups. Do you have competition? Yes you do. Can another business have a better business model that suits their startup but does not suit yours? It is very possible. Can they provide a faster or higher or both on ROI? Yup. Your job, in a pitching session, is not just comparing with your closest competitor, you are competing with everyone else for funding and even business partnership. In a big institutional setting, they are looking at the highest possible return at the most reasonable timeline. Due to the fact that they have a bigger asset under management (AUM), they can afford a longer timeline (even until post IPO). If it was a small boutique fund house or venture capital, limited fund size will mean they need to have a shorter timeline while being willing to give up on higher potential returns as they need to show their stakeholders results and returns in order to grow their own business and AUM. Remember, they, too, are a business.

Knowing Who You Are Pitching To

Knowing who they are, what are their investment timeline is, is crucial. You may be able to extrapolate some information off big headlines or via annual reports meaning you do need to spend time understanding how the bigger players operate. Of course every one wants the fastest and highest but they know that it is not possible. In my experience from personal interactions with some institutional analysts and decision makers, I found that they are very understanding. They even believe that some rejected cases can make it, it’s just that they are accountable for certain returns at a certain timeframe hence they pick the other. Yes, they will ask some hard questions because it is part of their designed SOP to filter out startups that do not fit that criteria. Don’t take it personally.

So remember guys

You are competing against other ideas from other industries too.

What is the institution’s typical timeline and who are you pitching to?

Can you align this so that you get the much needed funding?

Good luck on your pitch perfect session!